8 Curiously Common Mistakes That Investors Make

(And how you can avoid them!)

Over the years in which I have strived to help clients to make the best possible decisions about where and how to invest their money, I’ve observed the same mistakes being made repeatedly. Let’s go through these errors, and then look at how they can be avoided.

Nurturing unrealistic expectations: This can (all too easily) happen when people hear about the stock markets doing phenomenally well and their expectation is that (unrealistically) it will always do well, which is simply not true.

This point ties into not knowing one’s real tolerance for risk: When the market is doing well, people often think that they have a high tolerance for risk and they naturally seek maximum returns. Yet they forget that the market can, and will go down, and can do so at any time. Consequently, the investment needs to be in line with their real risk profile and not what they think it is when things are going well.

Being too conservative: Contrary to what many investors believe, there is a “cost” to structuring a portfolio too conservatively. Indeed, there needs to be some exposure to equities in a portfolio to get the growth that is hoped for. For example, retirees are often scared about losing their money so they want it positioned cautiously or conservatively (low equity and high cash). However, this will not give them the necessary returns over the years when they need the investment to grow in order to keep up with their drawdowns.

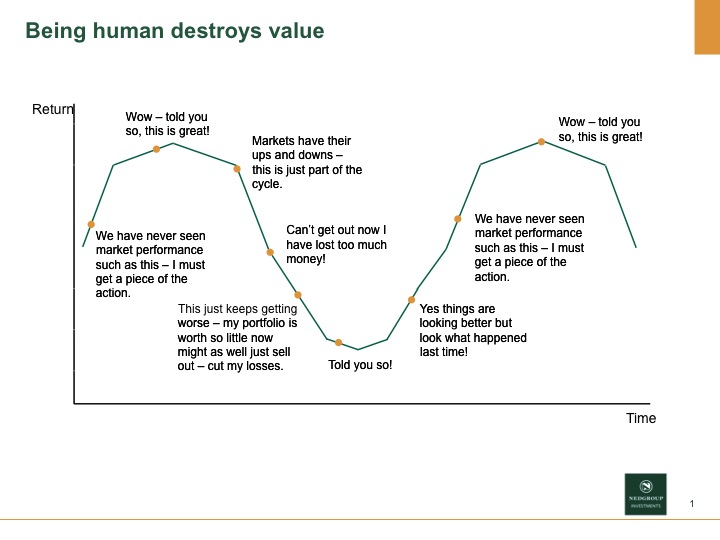

Buying high and selling low: People tend to get on the bandwagon too late when the stock market is getting higher (and perhaps overheated), so they are buying shares which are expensive – and the likelihood of them dropping is very high. Psychologically, it is difficult to buy a share when it is low and out of favour – but this is precisely the right time to buy a quality share. Excessive switching also falls under this heading – for example, people often want to go into unit trusts that are doing well and follow performance. Yet research has consistently shown that following performance can erode value… No unit trust is consistently a top performer!

Going into cash when the market drops: This is a notoriously difficult dilemma, as ideally one should sit it out and wait for the market to recover before selling. But sometimes people simply cannot deal with the stress of seeing their investment plummet. Also, it is difficult for people who are drawing an income as they are drawing on capital which is diminishing. It can be an option to go into cash if it is offering reasonable returns. If not, and the person is drawing an income, they are guaranteed to go backwards!

Investing on hearsay, gossip and rumour: This can be disastrous. It is far better to listen to a professional who will have researched thoroughly the reasons for investing in a particular share, and therefore fully understands the longer term prognosis for the share. Investing on impulse and/or a cool story in the paper can potentially be ruinous!

Neglect of your investments: Whilst people use the services of professionals to handle their investments, it is still a good idea for them to ask questions and have a general understanding of their investments and what is happening with them on a regular basis.

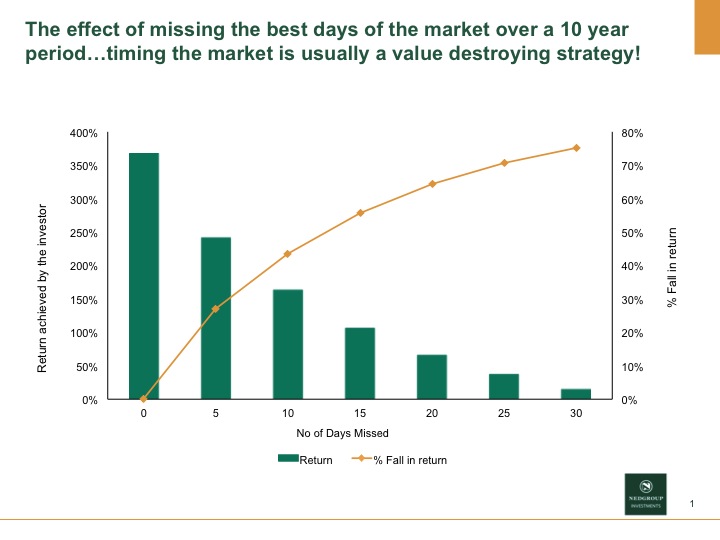

Nedgroup Investments’ graph which shows the effect of missing the best days of the market over a 10 year period… timing the market is usually a value destroying strategy.

What does this mean for you? The common factor underlying each of these mistakes is a natural tendency to act on one’s emotional reaction to money matters – instead of sitting tight and thinking rationally about one’s investments. By simply distracting oneself from unfavourable market/financial news and taking into account the views of a seasoned professional, people can avoid making critical mistakes that do long term damage to their financial well being.

Pingback : Should you listen to market commentators? | Castle Investments

Pingback : Looking ahead at Markets and Inflation | Castle Investments