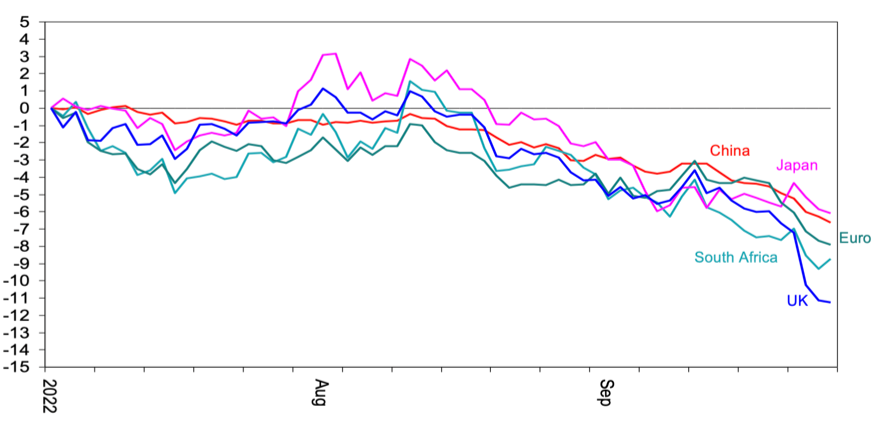

Tracking The US Dollar Strength

The USD has strengthened considerably, as it does in times of trouble – demonstrating its safe haven status. There are currently several global concerns overshadowing the markets, namely:

- The overhang of COVID;

- Increased cost of living due to increases in food and fuel;

- Post-pandemic supply constraints;

- The Russia/Ukraine crisis;

- Prospects of global recessions;

- The upward trend in global interest rates.

It is likely that over the next 3 to 6 months, global interest rates will continue to rise, and the USD will remain strong.

However, the current weakness across all currencies is not expected to become significantly worse unless:

- the global economic environment deteriorates further; or

- the world economy is hit by another shock.

Once these global concerns start to ease, significant foreign flows may move out of an over-valued USD and into assets that are considered under-valued.

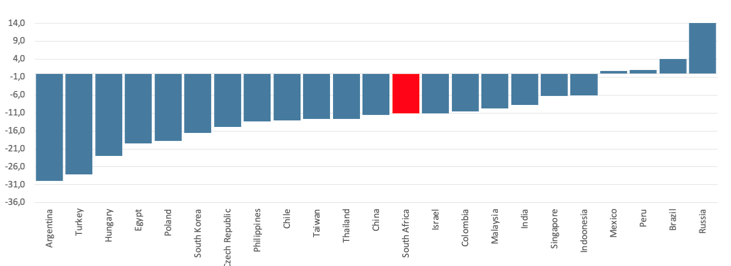

Notably, it would appear that most emerging markets, including South Africa, are nearing the top of their interest rate hiking cycle, despite the US and Europe continuing to raise rates. This is partly because emerging markets reacted early to the onset of inflation and raised interest rates very quickly. The US Federal Reserve and the European Central Bank argued that inflation was transitory, and this resulted in delaying rate hikes until inflation was at an uncomfortably high level.

Source: The Financial Times, Analytics Consulting FX Solutions