A Brief Review of the First Quarter of 2014 and Events That Moved the South African Market

While we are constantly bombarded with news of crises in every corner of the world – from tensions in the Ukraine to missing planes – it is hard to keep track of which events are affecting us right down to the so-called bottom dollar.

To simplify matters, here is a brief look at some of the occurrences and currency shifts that have shaped the markets in a rather eventful (and as always, unpredictable) way in the first quarter of 2014:

- In late January the rand slumped to R11.35/US$ and by the end of March it had recovered to just over R10.50/US$. This is still at a level weaker than throughout almost all of 2013. The rand remains fragile and at risk from any unfavourable global and local economic and/or political developments.

- No surprise here – the SA economy has been badly impacted by strikes, with a whopping 60% of the country’s platinum supply shut down since late January. This is massive – considering that the platinum sector has been one of the only areas of employment growth in SA mining over the past decade.

- Looking east to the all important Middle Kingdom, China ended 2013 with a growth rate of 7.7%. Most market watchers forecast that figure moving closer to the 7% mark – and if so, it will be the lowest pace of growth in 24 years! Definitely something we’ll be hearing more about in the course of the year.

- To more familiar territory, in the U.S. Ben Bernanke, the outgoing head of the Federal Reserve, bid his farewell. The central bank’s profligate bond-buying was also reduced to US$55bn per month. The newly appointed head of the Federal Reserve, Janet Yellen, hinted that rates in future may well normalise at lower levels than history would suggest.

And now for the more mundane kind of updates…

- Compared to 2013, we saw a sharp reversal in sector leadership. The industrial sector, for example, which gained 35% during 2013, returned 0.8% during the first quarter. However, the resource sector, which was almost flat for 2013, delivered a healthy 10.6% during the first quarter despite concerns around China’s economy.

- Financials, up nearly 19% last year, delivered another 6.1% during the first quarter of 2014.

- Listed property stocks, which are still struggling, shed more than 5%.

- Consumer spending in S.A. remains weak.

- Primarily driven by a deteriorating inflation forecast on the back of currency weakness, the S.A. Reserve Bank raised the repo rate by 50 basis points to 5.5% at their first scheduled meeting for the year. Old Mutual are of the opinion that whilst we can expect further hikes, they do not believe that this is the beginning of a strong interest rate upcycle. This is because the economy is still weak and they do not foresee inflation rising to the same extent as in previous cycles.

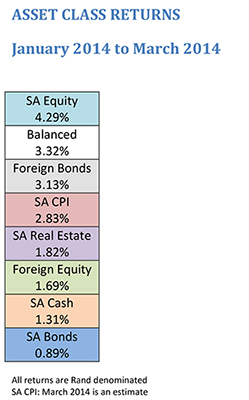

It is also interesting to look at how the different asset classes are performing so far this year:

With input from Sanlam Intelligence, Coronation Fund Managers and Old Mutual Investment Group.