Can Being Overly Cautious Present an Investment Risk?

We are all aware of the dangers of being too aggressive with your investment strategy – a good way to lose money is to allow greediness to replace good investment sense. But being overly-cautious is also a threat – read here about how your portfolio should be invested.

Current market volatility can result in investors being overly cautious. This can be an investment risk as caution could potentially be as harmful to a portfolio as being too aggressive.

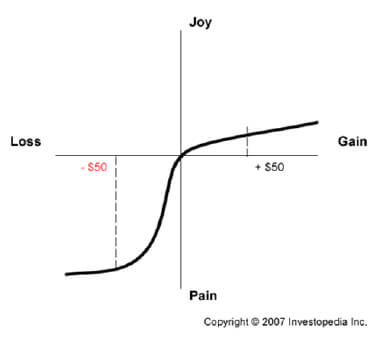

The source of the problem would appear to come down to the Loss-Aversion theory. Simply put, this theory states that ‘losing feels worse than winning feels good”.

The graph below shows how the loss of USD50 is more keenly felt than that gain of USD50.

Being overly cautious is an emotional bias, that has an opportunity cost. In the world of investments it is the equivalent of insisting on having your money invested and, at the same time, always feeling that a market correction is imminent and aligning your portfolio accordingly. A consistent belief that money will be lost and waiting for a better entry point does not make for a sound investment strategy.

Although it is extremely hard, the best way to create future wealth is to try to remove emotion from the equation. This does not mean abandoning caution altogether but rather keeping your investment diversified across the different asset classes and aligned with your personal risk profile which would take into account the amount of risk you are prepared to take and how much capital you are prepared to commit.

It is also important not to have a knee jerk reaction to ‘noise’ in the media around short-term market movements (particularly on the downside).

Source: MitonOptimal