Tariff Uncertainty

The US has announced sweeping tariffs on imports.

How were the tariffs calculated?

They are based on the size of the US’s trade deficit with each country, calculated as a percentage of total trade and then halved. The rationale of this formula has been criticized by those who believe there is no economic justification.

Some Key Points From South Africa’s 2025 Budget…

• VAT Increase:

The budget includes a 0.5% increase in the Value Added Tax (VAT) rate, with a potential further increase of 0.5% in 2026.

• Economic Growth:

The country’s growth is estimated to reach 0.90% for 2025, while the Budget assumes a growth rate 1.90% for 2026.

• Spending Priorities:

Key spending areas include Learning and Culture (Education), Social Development (Grants and Welfare), Health Services, Community Development (Infrastructure & Housing), and Economic Development (Job Creation & Innovation).

• Retirement Fund Proposals:

The two-pot system for retirement funds remains in place, with no changes to the ability of members to access their retirement component until retirement.

• Personal Income Tax:

Personal income tax brackets and rebates will not be adjusted for inflation in 2025/26.

Note: South Africa’s 2025 budget is still subject to parliamentary approval and potential amendments.

The Recent Suspension of Load Shedding in South Africa…

The Generation Operational Recovery Plan which commenced on March 2023, continues to ensure a consistent energy supply and improved efficiencies, with loadshedding remaining suspended. As of September 20, Eskom has achieved 177 consecutive days of uninterrupted power supply since 26 March 2024.

Key factors contributing to this include:

Sa’s Progress Towards Exiting Greylisting

- In February 2023, South Africa was placed on the Financial Action Task Force (FATF) Greylist due to shortcomings in its Anti-Money Laundering and Counter-Terrorism Financing.

- As of mid-2024 authorities are working to address the 14 outstanding action items in a plan that extends through early 2025.

- National Treasury have reported some progress and the aim is to resolve these deficiencies by June 2025.

Source: National Treasury Department

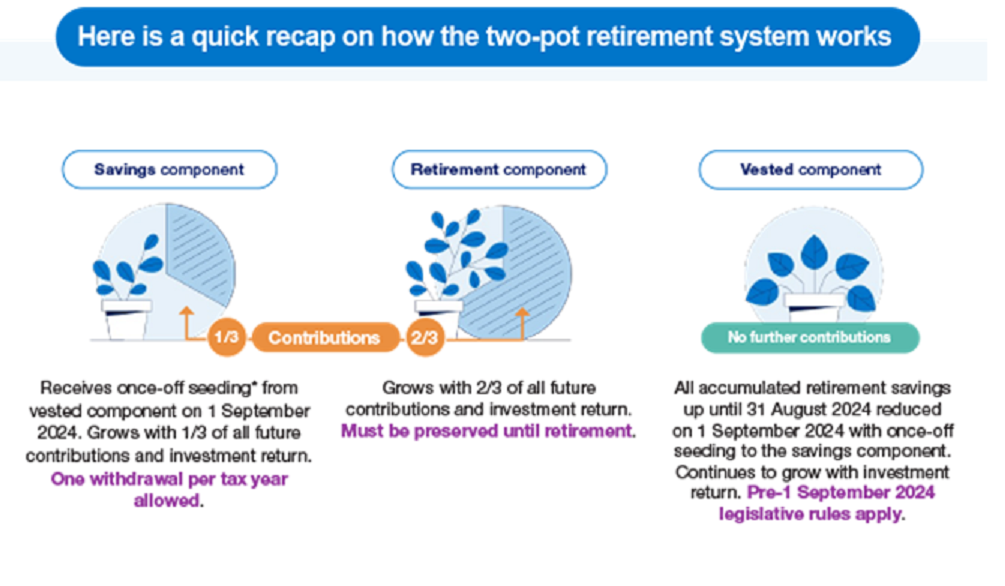

Two-Pot Retirement System Quick Recap

Here is a quick recap on how the two-pot retirement system works. Read our full article here “Two-Pot System That Became the Three Component System”.

Source: Sanlam

Feedback on the Second Quarter 2024

LOCALLY, in general …

The National Election dominated the news. The resultant more centrist coalition (Government of National Unity – GNU) saw a rally in the Rand and a surge in domestic equities.

The economic outlook for SA has improved and the GNU has an opportunity to raise business and consumer confidence from an extremely low base.