The Unpredictable Rand

In this Moneyweb article, the case is put for offshore exposure being important for diversification and to protect purchasing power. Click here to read the article.

Stay Calm

Now is the time to practice the art of simply staying calm…

In a time of great flux and instability, many investors are (naturally) observing markets and the wider economy with anxiety and concern. Indeed, with so much volatility and nay saying, the natural inclination is to disinvest and sit on the sidelines.

What Is the Optimal Offshore Weighting

For South African investors, it is critical to build in exposure to offshore markets. One of the primary reasons for this is that the JSE All Share Index is heavily weighted towards a relatively small number of shares. The key question then becomes: what is the optimal percentage of offshore exposure in a diversified portfolio?

Now Is the Time to Keep a Clear Head…

Shaun le Roux from PSG Asset Management advises investors to keep calm amidst the chaos. (The following is an abridged version of an article from Moneyweb).

For South African investors, the headline news at the moment is almost universally bad. Politically and economically, the country is facing very challenging times.

Market Dynamics Are Changing

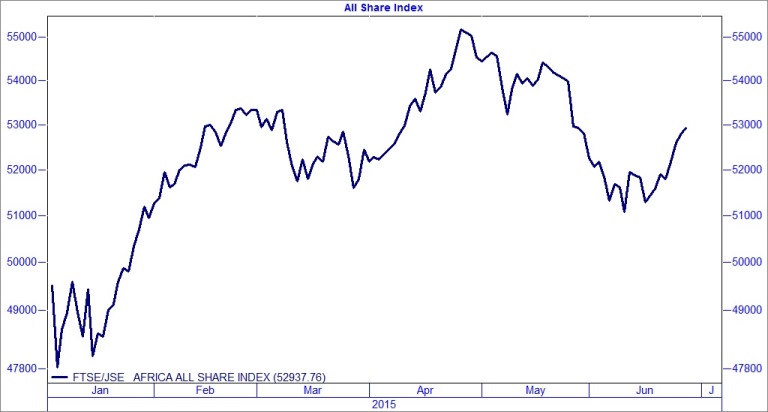

It has been a topsy-turvy ride on the stock exchange, as this graph shows. It also shows there is little point in being concerned about short-term movements. Since the middle of 2014 movements have been in a fairly narrow band, hovering between about 47 000 and 54 000. The moral of the story is one needs to invest for the medium to long term and not over react to short term market fluctuations.

How Should Investors Approach Heightened Market Volatility?

As I have mentioned repeatedly on this blog, we are currently experiencing heightened volatility in the financial markets.

In the realm of behavioural finance, there is a term ‘action bias’ which refers to one’s inclination to do something in times of stress and uncertainty (and there has been a lot of that in the financial markets recently). Some investors may be asking, ‘do we make drastic changes to our investment strategy by moving 100% into cash for fear of losing more?’

Don’t Give up on Equities Just Because Interest Rates Are Rising

Investors should not be spooked by a climate of increasing interest rates – shares (equities) remain a good place to be invested, writes Patrick Cairns for Moneyweb. Click here to read the article “Don’t give up on equities just because interest rates are rising”

Rollercoaster Ride on the JSE

It has been another roller-coaster ride on the JSE, as the graph below shows. The sometimes steep ups and downs of the exchange illustrate why long-term investors should not be alarmed by short-term market movements. From a drop at the beginning of the year, the All Share Index went up steeply, albeit not in a straight line, until mid-March, when it took a breather, before soaring to a record high at the end of April. But May and June saw it drop – external influences such as fears of a Greek default, or worries about when US rates would be hiked – have been cited as amongst the factors influencing that drop. But come June the index went jogging upwards again. So it has been said before but it is worth repeating here – investors should not lose sleep over short-term volatility.