How Should Investors Approach Heightened Market Volatility?

As I have mentioned repeatedly on this blog, we are currently experiencing heightened volatility in the financial markets.

In the realm of behavioural finance, there is a term ‘action bias’ which refers to one’s inclination to do something in times of stress and uncertainty (and there has been a lot of that in the financial markets recently). Some investors may be asking, ‘do we make drastic changes to our investment strategy by moving 100% into cash for fear of losing more?’

Here, the action bias can invoke a strong desire to make radical changes to avoid losses – but typically, one finds it very difficult to get back into the market once out, particularly after a drop, when it would be most beneficial. Follow the link for more on this “8 Curiously Common Mistakes That Investors Make”

Essentially, if we are to achieve inflation-beating returns, we need to take on some risk. And if we are going to take some risk then periods of losses are a certainty – but these losses are not a problem in the long run…whereas selling when you have a loss and ‘locking in’ those losses can be harmful.

The action bias frequently tends to lead to short-term, emotional decisions, the benefits of which do not always outweigh the risk. If the action bias leads one to want to do something, we need to take actions that are constructive and unemotional.

Here are a few simple rules to guide you through the current uncertainty:

- Recognise that volatility and periodic corrections are common in equity (share) markets, and that swings in the financial markets are normal and relatively insignificant over the longer term. The best approach to protect portfolios is to diversify among the broad mix of asset classes (shares, bonds, cash, property, offshore) so that your portfolio is better positioned to buffer the declines in the share market. It is also important to be invested according to your personal risk profile, which determines how much risk you can take on.

- Ignore the ‘noise’ in the media, of which there is plenty at the moment, and remove emotion from investing.

- If your portfolio is broadly diversified, and the risk profile is appropriate to you (in other words, is appropriately positioned for your financial goals, time horizon and risk comfort level) don’t change anything!

- Continue to invest regularly. If you are investing regularly, you’re making the market’s volatility work for you. Buying a fixed rand amount on a regular basis offers you opportunities to buy at a lower price when the market drops. Over time, regular contributions can help reduce the average price you pay for your investments.

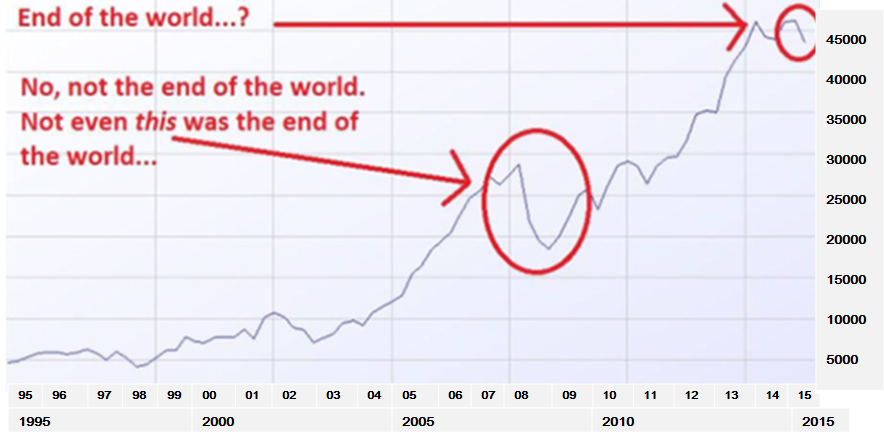

The graph below (click on graph for greater clarity) keeps things in perspective!

Source: FPI Retirement & Investment Convention, presentation by Warren Ingram

Source: FPI Retirement & Investment Convention, presentation by Warren Ingram

Source: Investec Wealth & Investment