Hurry up and Wait!

(An argument for sitting tight when the news is bad…)

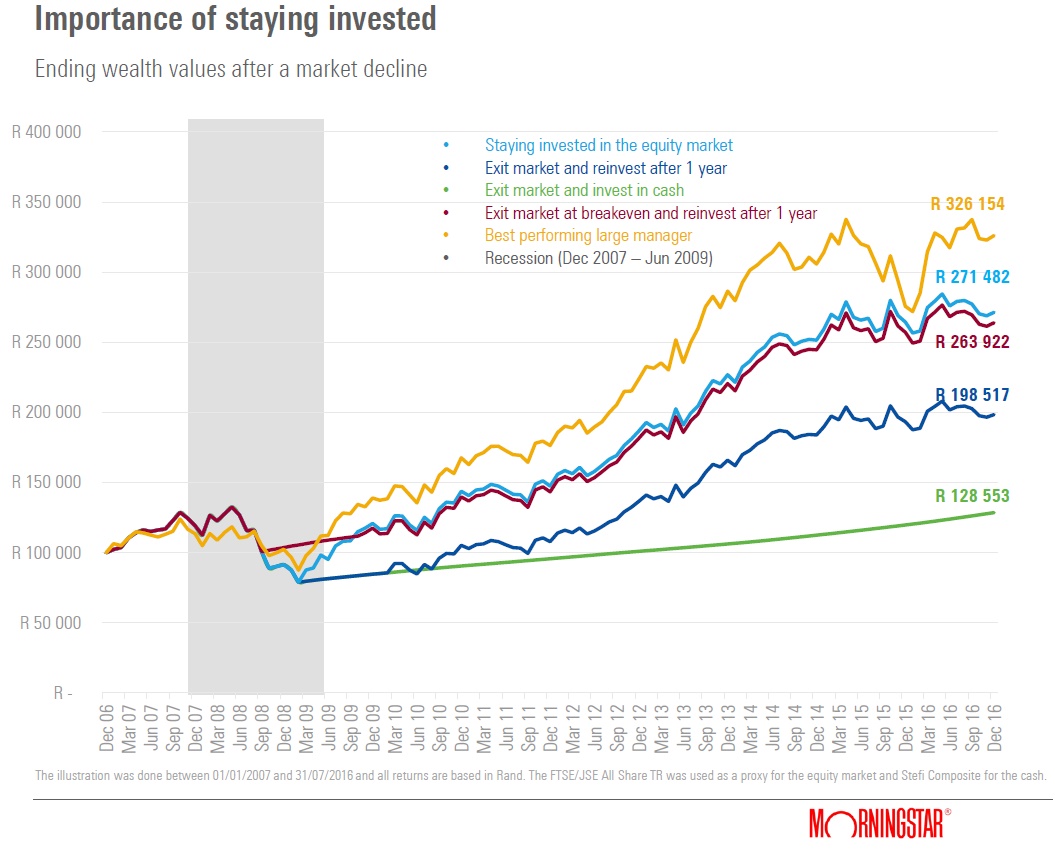

While it is true that no one has a crystal ball for financial markets, there is some interesting research available that shows what has happened in the past during difficult times. Arguably, this research illustrates the point that often, the smartest thing to do is to wait! (click on the graph to enlarge)

Why stay invested?

Investor behaviour is of the utmost importance, and particularly when performance is negative and financial markets are in turmoil.

“Investment results are more dependent on investor behaviour than on fund performance” – Dalbar Research (2011).

I have previously posted on this blog about the dangers of trying to time the market (see “Staying Invested Vs Timing Markets”) and how missing the best few days of market performance can affect the returns of an investment (see “Timing the Market”).

Indeed, we cannot predict when the best days will occur – so this increases the risk of being out of the market.

Without doubt, there are circumstances whereby risk is not appropriate and the above strategy cannot be employed by every investor. However, the risks of an emotional reaction to difficult times in the market need to be avoided – and any disinvestment or change in portfolio construction needs to be clearly and logically thought through!

Source: Allan Gray