Stay Calm

Now is the time to practice the art of simply staying calm…

In a time of great flux and instability, many investors are (naturally) observing markets and the wider economy with anxiety and concern. Indeed, with so much volatility and nay saying, the natural inclination is to disinvest and sit on the sidelines.

Amidst this climate, the smartest strategy is to simply remain calm and stick to your investment plan.

Here’s why…

If one looks at the JSE All Share Index (or the stock market) over the last 10 years, it has been quite beneficial to investors. However, it does not perform in a straight upward line and can at times be volatile. The lesson here is that one needs to understand that volatility – while difficult to stomach when markets are choppy or declining – creates opportunities to deliver inflation-beating returns when markets rise.

So while this period of market turmoil seems hard to endure, the real difficulty comes when investors decide to disinvest and move to the (perceived) safe haven of cash – potentially missing out on a market rebound. I have mentioned before the danger of trying to time the markets (Staying Invested Vs Timing Markets).

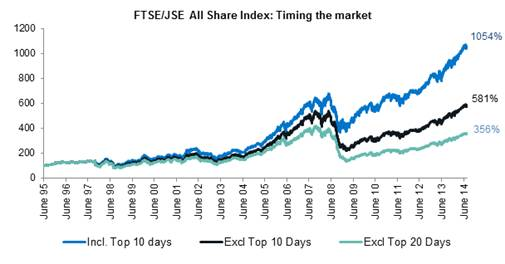

The graph below depicts an investment: If investors had stayed invested; missed the best 10 days; and missed the best 20 days of the JSE All Share Index since 1995.

- You will see that if investors had stayed invested over the 20-year period, they would receive over 1000% compounded over this period, or 13.2% per annum.

- However, should they have missed the best 10 days in the market, the return would basically be cut in half and they would only receive 581% compounded or 9.7% per annum.

- This gets worse if investors had missed the top 20 days.

The bottom line?

If you are investing in equities (shares), you should typically have a long-term horizon. However, if you have a short term mindset, it can lead to panic selling during volatile periods – which can result in sup-optimal outcomes as market timing (both in and out of markets) is incredibly difficult…

Source: Sanlam Multi Managers