Staying Invested Amidst a Global Shock

The global outbreak of coronavirus or Covid-19, coupled with the sharp fall in oil prices, has created immense fear in the global financial markets. These are exogenous shocks which are difficult to anticipate.

Unsurprisingly, there are deep-seated concerns around the impact on global growth – and whether or not this will lead to a global recession. As a result, volatility has spiked, and we have seen a flight to safety.

It is precisely during times of market stress that investors make emotional decisions such as switching their investments to cash, which can negatively affect long-term wealth creation. This requires timing the market, which is an extremely difficult task. I have written about timing the market previously on this blog (see “Timing the Market”). As always, it is important to remain calm and to stick to your long-term investment plan.

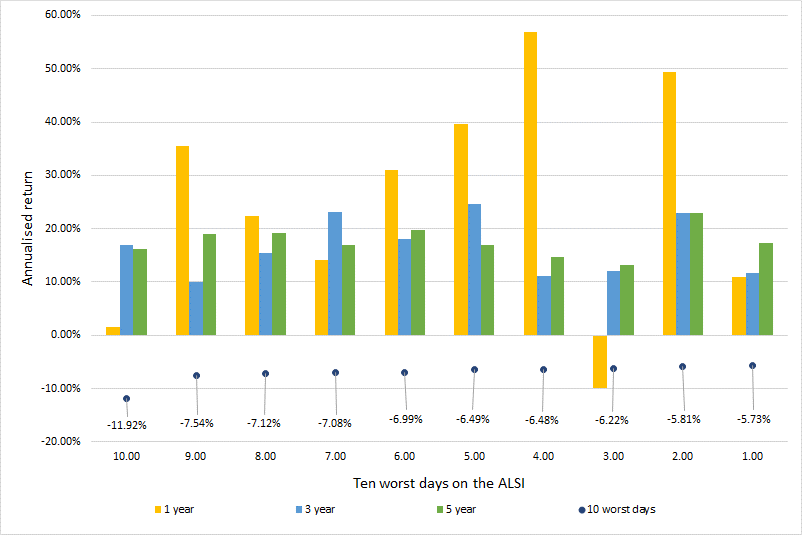

Looking at the bar chart below:

The y-axis shows annualised returns, while the blue dot represents the ten worst daily drawdowns -with the corresponding bar charts showing the subsequent returns after those drawdowns occurred.

The data above suggests that you are rewarded for staying invested and that the equity markets do, in fact, rebound.

Source: Glacier by Sanlam