Staying Invested Vs Timing Markets

At times like these, when the financial markets are very volatile, it is tempting to try and “time” the markets by selling when they are going down and then re-entering when they are recovering.

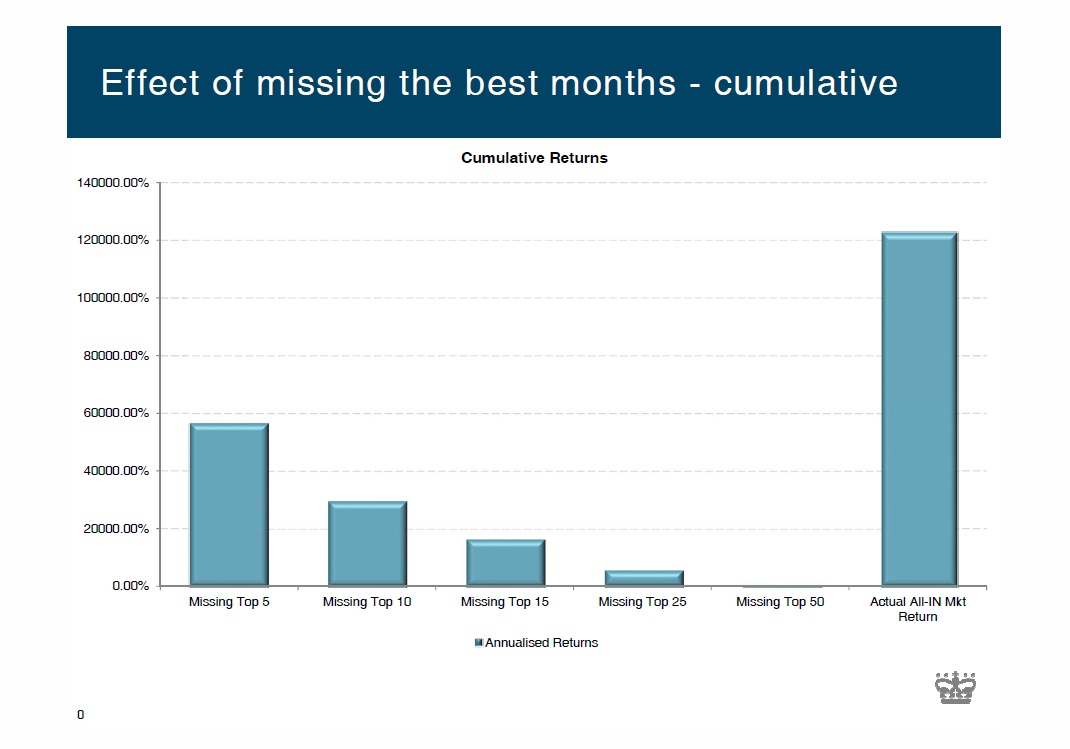

The problem is that one cannot predict when the markets have bottomed nor when they are on a sustainable rise. I mentioned this in an article I posted in March 2014 to see the article click on the link “8 Curiously Common Mistakes That Investors Make”. Missing out on the best trading months of the year can have a significant (negative) effect on one’s portfolio. See below the graph by Coronation Fund Managers which clearly illustrates this.

Source: Coronation Fund Managers