What Is the Optimal Offshore Weighting

For South African investors, it is critical to build in exposure to offshore markets. One of the primary reasons for this is that the JSE All Share Index is heavily weighted towards a relatively small number of shares. The key question then becomes: what is the optimal percentage of offshore exposure in a diversified portfolio?

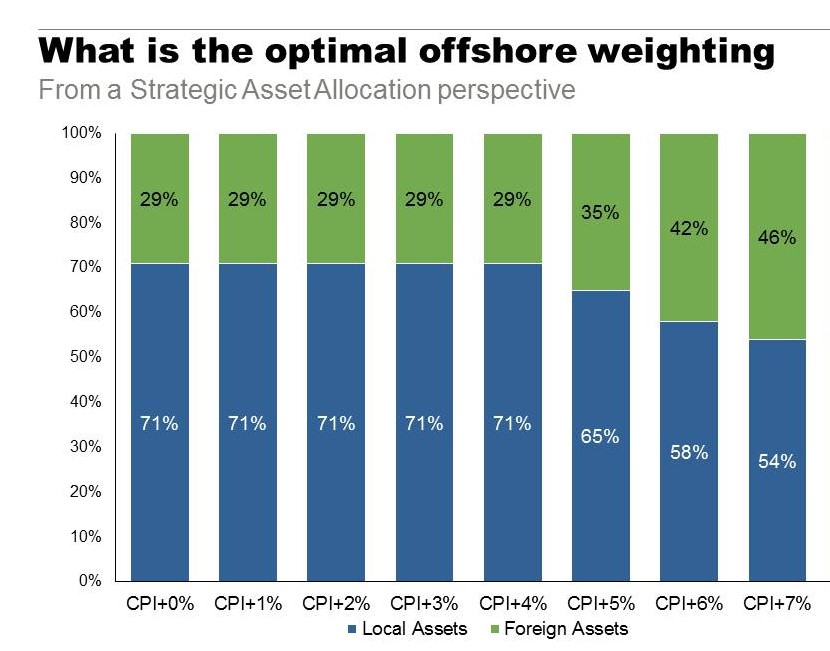

Whilst personal circumstances, preferences and risk appetites certainly need to be taken into account, it is worth noting Cadiz Securities’ perspective on local vs. offshore allocations (see below).

In this case, CPI is taken to be 6% – so a portfolio of CPI + 1% or CPI + 2% would be considered a conservative portfolio. A portfolio of CPI + 5% would be considered an upper moderate portfolio. Notably, pension, provident and preservation funds as well as retirement annuities are restricted to 25% offshore exposure.

Source: Cadiz Securities/Investec Asset Management