A Perspective on Rand Weakness Against the USD

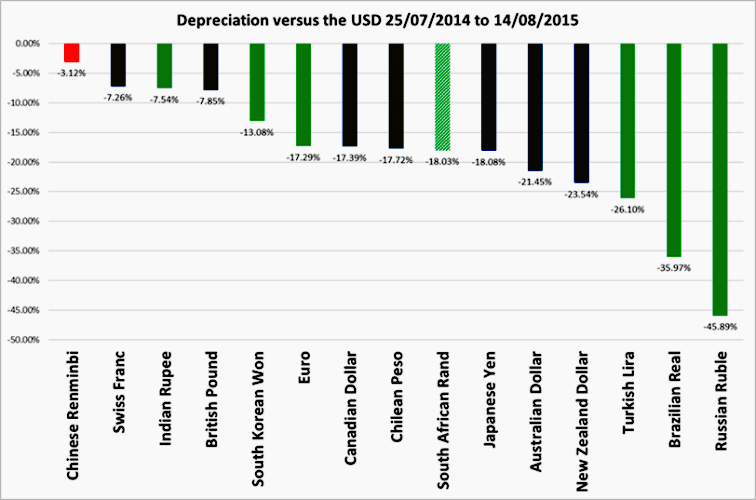

With the rand breaching R13/USD for the first time in 14 years, it is timely to look at how major currencies have fared against the dollar over the period 25 July, 2014 – 14 August, 2015 and the analysis is interesting.

The above graph (click on graph for greater clarity) shows that:

- Nearly all major currencies have weakened against the USD, with emerging and commodity currencies * being particularly hard hit.

- Developed commodity currencies, e.g. Australian, New Zealand and Canadian Dollars have performed worse than the rand over this period.

- The rand has performed in line with major currencies such as the Japanese Yen and Euro.

- The British pound has been one of the better performing currencies against the USD.

- The Chinese Renminbi, even after the recent devaluation, remains a top-performing currency against the USD in contrast to other emerging markets**.

- Of the BRICS (Brazil, Russia, India, China, South Africa), South Africa has fared better than both Brazil and Russia.

* Commodity currencies is a name given to currencies of countries which depend heavily on the export of certain raw materials.

** SA is considered to be an emerging market along with, for example, Brazil, Russia, China, India.

Source: Brandon Zietsman, CEO, PortfolioMetrix