Why ‘timing’ the Market Can Be Very Costly…

As year-end approaches, it is useful to remind investors of some of the basic principles that make for successful long-term investment strategies. In the face of local instability on the economic and political fronts, such principles become critical to adhere to.

In my view, it helps to start with the numbers themselves…

When the JSE went to 61 211 (21/11/17), one could forget that earlier in the year it was sitting at 50 653. This highlights the futility of trying to time the market. The key, as always, is to stick to a well thought out investment strategy – and to avoid emotional reactions to negative market movements. We have tackled this topic before here.

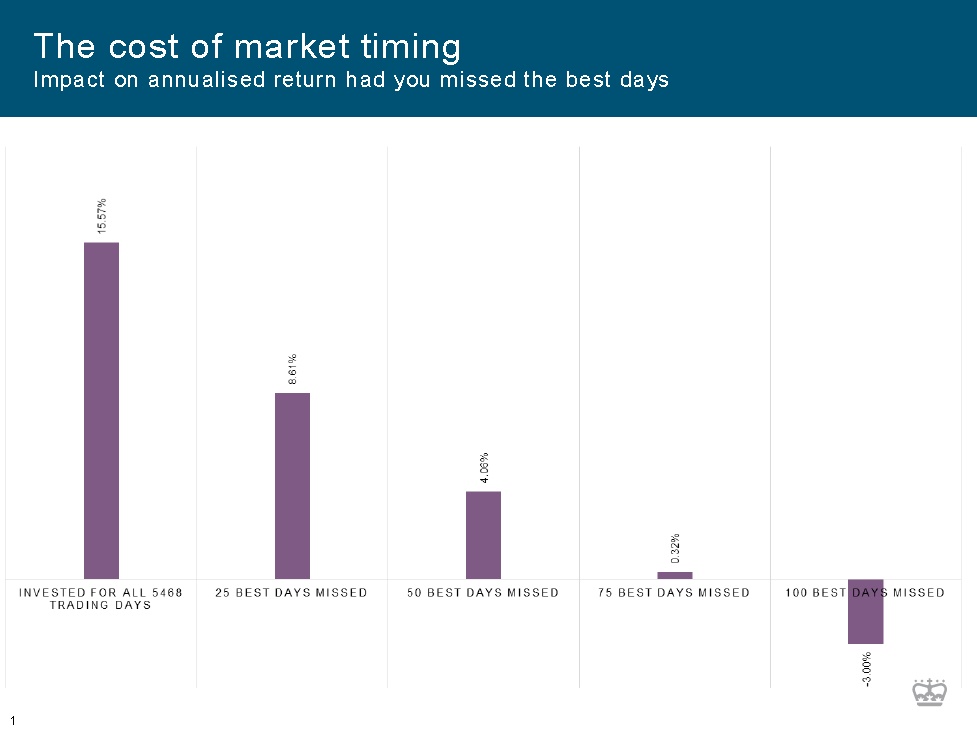

Notably, the graph below demonstrates the impact on annualised returns – should you have missed out on the best trading days.

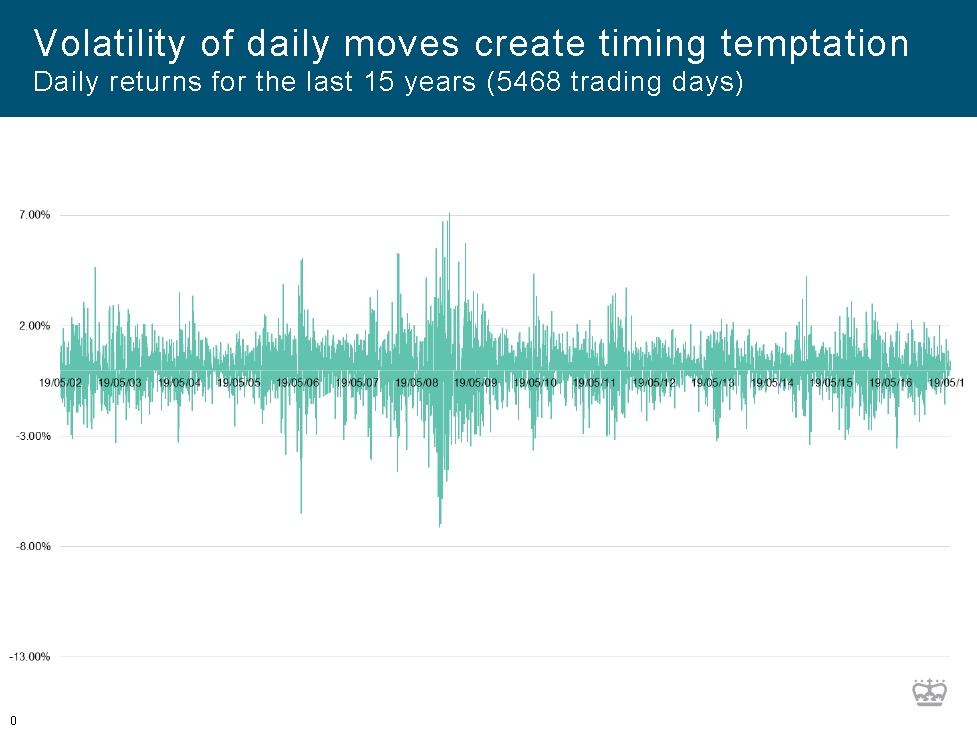

This second graph illustrates the volatility of daily moves – that create the notorious ‘timing temptation’.

Source: Coronation Fund Managers