Happy Holidays

It has been an interesting year on the financial front, what with South Africa having three finance ministers in one week, downgrading by credit agencies, and the volatility which we have become used to on the JSE. But your investments have held up in spite of a challenging 2015, and we look forward to continuing to grow them in 2016. All the very best for the festive season from Castle Investments.

SA Risks Junk Status

On Friday, 4 December, Fitch Ratings and Standard & Poor’s cut SA’s credit rating from stable to negative (BBB-), bringing the country closer to a junk rating.

A reason for the downgrade included:

- Weakening Growth domestic product (GDP) growth performance and estimates of it weakening further.

South Africa’s economy narrowly avoided a recession in the third quarter of 2015 with an annualised growth of 0.7% because of electricity shortages, low global demand and falling commodity prices.

Some economists now believe that the risk of a junk rating is not impossible.

Source: Bloomberg

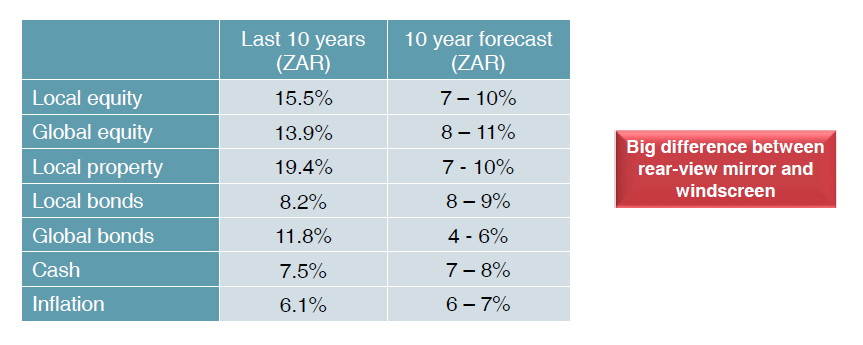

Expected Asset Class Returns over the next 10 Years

In March 2014, we posted an article (which included a graph prepared by Coronation Fund Managers) which detailed their expected view of asset class returns over the next 10 years “Looking ahead at Markets and Inflation”. This has been updated, and you will notice there have been a few changes. As with all predictions, however, this is just a forecast and things can certainly change quickly.

Source: Coronation Fund Managers

Interest Rate Prognosis

Yesterday the South African Reserve Bank (SARB) hiked the repo rate by 25bps to 6.25%.

In essence the Reserve Bank:

- Is more concerned that inflation will move to the upper end of the target range and that a number of factors, namely, electricity prices, the exchange rate and higher food inflation, could push inflation above the target on a persistent basis.

- Acknowledges that the economy remains very weak but their primary mandate is to keep inflation under control.

The tone and focus of the Reserve Bank’s statement together with an expectation that inflation is expected to move higher in 2016 suggests that the Reserve Bank will continue to increase interest rates in 2016.

Source: Kevin Lings, Chief Economist, Stanlib

When the Fed Starts to Hike…

Markets could be in for an interesting ride with the US and UK likely to raise interest rates while Europe and Japan try to keep rates low. This will make for a divergence of policies that global economies haven’t experienced for quite some time and investors should expect markets to go through volatile periods. Click here to read the Moneyweb article “When the Fed starts to hike…”

How Should Investors Approach Heightened Market Volatility?

As I have mentioned repeatedly on this blog, we are currently experiencing heightened volatility in the financial markets.

In the realm of behavioural finance, there is a term ‘action bias’ which refers to one’s inclination to do something in times of stress and uncertainty (and there has been a lot of that in the financial markets recently). Some investors may be asking, ‘do we make drastic changes to our investment strategy by moving 100% into cash for fear of losing more?’

Keeping an Eye on China

China is South Africa’s largest single country trading partner. In the past few weeks we have seen significant volatility in the Chinese stock markets as well as a devaluation of their currency. This has impacted on China’s main trading partners as well as emerging market* currencies and equities (shares) in particular.

Don’t Give up on Equities Just Because Interest Rates Are Rising

Investors should not be spooked by a climate of increasing interest rates – shares (equities) remain a good place to be invested, writes Patrick Cairns for Moneyweb. Click here to read the article “Don’t give up on equities just because interest rates are rising”