Nene’s Hospital Pass

Nene’s Hospital Pass is an interesting article by Moneyweb on the 2014 Medium Term Budget. Click to read the article: “Nene’s Hospital Pass”

Plan for Higher Inflation

Further to a previous post which suggests that we are moving into a higher inflation environment “Looking Ahead at Markets and Inflation” the following is another graph by Coronation Asset Managers which shows how higher income earners need to plan for increasing inflation.

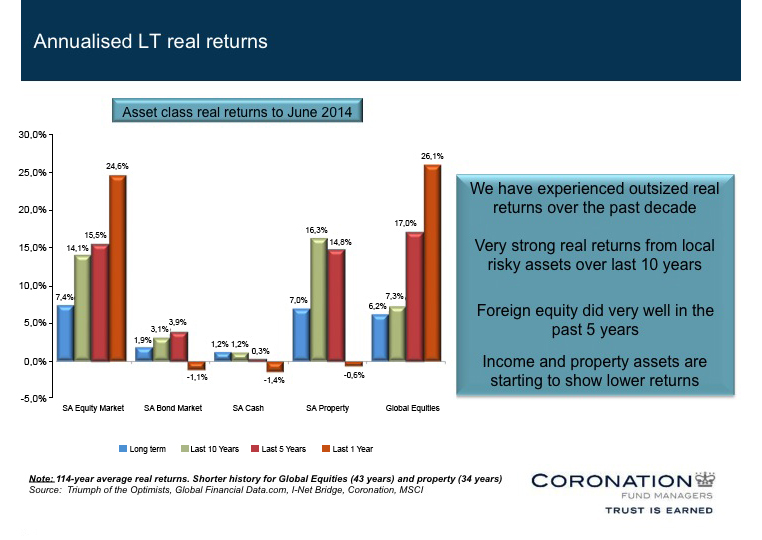

Annualised Long Term Real Returns

I refer to a previous post on the blog “Looking Ahead at Markets and Inflation“ which gives Coronation Asset Managers’ perspective on the returns of financial markets going forward. This is another interesting graph which gives the long term averages. You will see that these are lower than the returns for the various asset classes over the past 10 years, 5 years and 1 year. Markets tend to revert to their long term averages. This graph therefore supports their view that going forward, returns will be more muted.

Shares and tax: The facts

The taxman wants his bite from individuals investing directly in the stock market. In this article Moneyweb has some sound advice regarding shares and tax. Click to read the article: “Shares and tax: The facts”

Tax and Investments: How to Invest Tax-free

And sometimes we get a tax break. Click here to read “How to invest tax-free”, a Moneyweb article which describes how we will be able to invest R30 000 tax free per annum (up to an amount of R500 000) from March 2015.

Tax and Investments: Endowments

In this second article in our Tax & Investments series, we deal with tax and endowments.

Let’s start with the basics…

An endowment is a fixed term savings policy with a minimum term of 5 years.

During the 5 year term you can make one withdrawal, which you don’t pay back. The amount you can withdraw is restricted.