Why Balanced Funds Are Holding More Cash

With the JSE’s All Share Index at new highs (closed on the 24th of June at 50 890) it is interesting to note that a number of balanced fund managers are holding a larger percentage of cash in their funds. Coronation, Allan Gray and PSG Fund Managers explain their rationale for this in a Moneyweb article. Click to read the article: “Why balanced funds are holding more cash”

Preservation Funds Q&A

As with Life and Living Annuities (“Life and Living Annuities Q&A”), I often find that there is a great deal of confusion and misunderstanding around preservation funds, and how they work.

To address this confusion, we have compiled a brief Q&A which aims to promote a better understanding of preservation funds, how they work, and their benefits…

IN THE NEWS: Foreign Capital Flows Back into SA

The rand has been on a roller-coaster ride, as has sentiment towards the JSE and other emerging-market stock exchanges. What is behind the volatility and what is the outlook? Moneyweb investigates. Click here to read the article.

Retirement Annuities Q&A

A retirement annuity can be an excellent vehicle to save for your retirement, particularly if you are a small business owner or a self-employed professional – and therefore do not contribute to a corporate pension or provident fund.

Furthermore, even if you do belong to a corporate pension/provident fund, there may be tax benefits to be gained from contributing to a retirement annuity.

To provide further insights into this, we have put together a Q&A which explains what retirement annuities are, and how they work…

How Much Should You Withdraw from Your Living Annuity Each Year?

This is a difficult question to answer, and one which many retirees are forced to grapple with.

In terms of current SARS practice, you are allowed to withdraw no less than 2.5% and no more than 17.5% of the capital amount of the living annuity fund per annum (for more information on annuities read our article “Life and Living Annuities (Q&A)”).

Let’s break this down…

For the purposes of this exercise, it is assumed that the growth in the nominal value, i.e. the actual percentage growth earned on the investment of ‘the capital’ in the living annuity fund, will increase in value by 10% per annum. Note, however, that this rate of growth is an assumption which may or may not be achieved.

A Brief Review of the First Quarter of 2014 and Events That Moved the South African Market

While we are constantly bombarded with news of crises in every corner of the world – from tensions in the Ukraine to missing planes – it is hard to keep track of which events are affecting us right down to the so-called bottom dollar.

To simplify matters, here is a brief look at some of the occurrences and currency shifts that have shaped the markets in a rather eventful (and as always, unpredictable) way in the first quarter of 2014:

Life and Living Annuities (Q&A)

There is a great deal of misunderstanding surrounding the rather complex world of life and living annuities. Indeed, these products are often confusing and difficult to navigate for the lay person.

Below is a Q&A that seeks to simplify these products and promote a better understanding of their benefits and potential drawbacks…

Rethinking Retirement

In the not too distant past, retirement was a very straightforward process for most working people.

The average middle class working professional would spend a substantial number of years (if not their entire working life) working for the same company. When a certain, specified age was reached the employee was then waved off with a pension package that would be sufficient to allow him or her to maintain a decent standard of living as an official retiree.

All very reassuring, right?

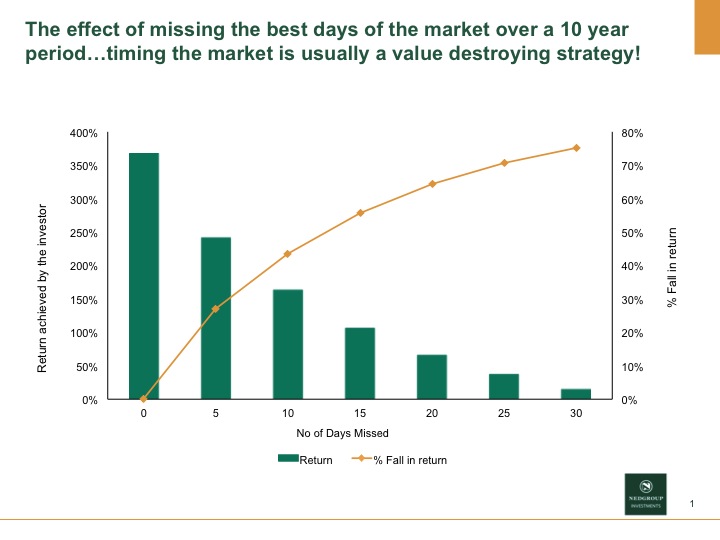

Timing the Market

“Timing the market is usually a value destroying strategy!” Have a look at Nedgroup Investments’ graph which shows the effect of missing the best days of the market over a 10 year period. Read more about investor mistakes in our “8 Curiously Common Mistakes That Investors Make” article.