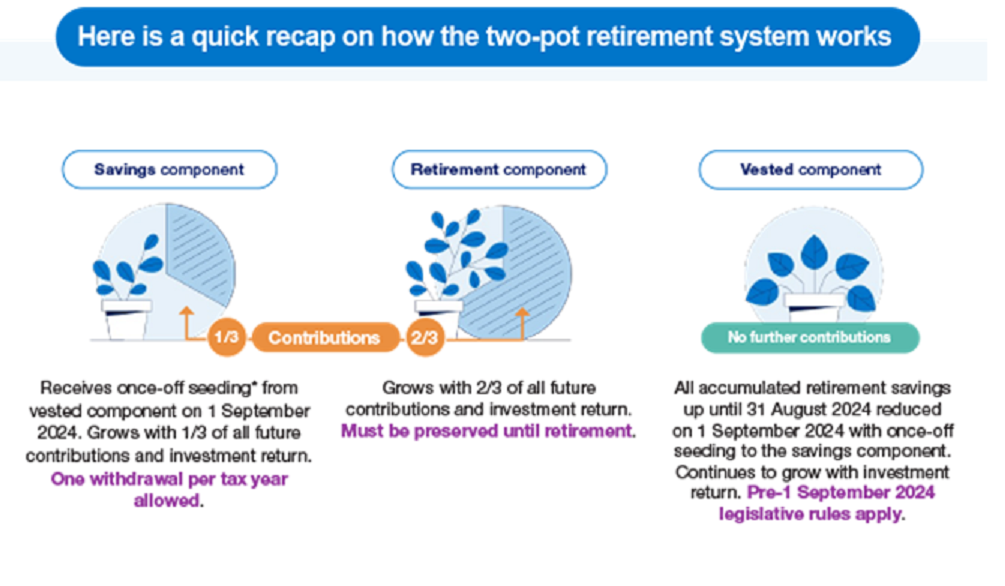

Two-Pot Retirement System Quick Recap

Here is a quick recap on how the two-pot retirement system works. Read our full article here “Two-Pot System That Became the Three Component System”.

Source: Sanlam

Two-Pot System That Became the Three Component System

Latest Update: Proposed implementation date 1 September 2024.

The rationale behind the legislation is to empower more South Africans to preserve their retirement savings when changing or leaving a job, while also allowing people to access their savings component if they experience financial hardship.

‘Don’t Put Baby Boomers out to Pasture!’

Too young to retire from an active business life, yet seen in many workplaces as being too old to be of any use – this is the lament of the Baby Boomers, those people born after the Second World War in the so-called baby boon years between 1946 and 1964. But, argues Marilyn Hallett, it is a big mistake to put the Boomers out to pasture. Click here to read the article. Also see previous article “Rethinking Retirement”

The Accidental Investor: Shy of Retiring

The Accidental Investor by our contributor, Nick Warren, returns with his thoughts on retirement…

Retirement is wasted on the old. It is best suited to the young and dynamic. Those you read about in business and lifestyle magazines. The young bucks that make their fortunes and build their empires and ‘retire’ at 35 only to saunter back onto the front covers with new ventures as 40-year old veterans.

Preservation Funds Q&A

As with Life and Living Annuities (“Life and Living Annuities Q&A”), I often find that there is a great deal of confusion and misunderstanding around preservation funds, and how they work.

To address this confusion, we have compiled a brief Q&A which aims to promote a better understanding of preservation funds, how they work, and their benefits…

Retirement Annuities Q&A

A retirement annuity can be an excellent vehicle to save for your retirement, particularly if you are a small business owner or a self-employed professional – and therefore do not contribute to a corporate pension or provident fund.

Furthermore, even if you do belong to a corporate pension/provident fund, there may be tax benefits to be gained from contributing to a retirement annuity.

To provide further insights into this, we have put together a Q&A which explains what retirement annuities are, and how they work…

How Much Should You Withdraw from Your Living Annuity Each Year?

This is a difficult question to answer, and one which many retirees are forced to grapple with.

In terms of current SARS practice, you are allowed to withdraw no less than 2.5% and no more than 17.5% of the capital amount of the living annuity fund per annum (for more information on annuities read our article “Life and Living Annuities (Q&A)”).

Let’s break this down…

For the purposes of this exercise, it is assumed that the growth in the nominal value, i.e. the actual percentage growth earned on the investment of ‘the capital’ in the living annuity fund, will increase in value by 10% per annum. Note, however, that this rate of growth is an assumption which may or may not be achieved.

Enjoying Retirement: A Letter to My Daughter

I mentioned when I started the blog that I would post the occasional light hearted article. This is one of them. Peter Sullivan, former Editor-in-Chief of Independent Newspapers and one of our contributors, is someone who is particularly adept at living a portfolio life (click here to read “Life Can Be Good in a Portfolio Life”). He is retired but is as busy and active as he’s ever been (have a look at our recent article “Rethinking Retirement”). He recently celebrated his 65th birthday by going on a cycle tour through the Karoo with a group of friends. Here he describes the joys of the experience in a letter to his daughter, Helen, who is working in the United States…

My darling daughter Helen

What a pity you couldn’t join my 65th birthday cycle ride through the Karoo. You would have loved it. Happy as you are in New York, South Africa is still special to you I know, and the Karoo a very special part of it. Your great-grandfather was born there. Cycling is the best way to see it, specially with friends.

Life and Living Annuities (Q&A)

There is a great deal of misunderstanding surrounding the rather complex world of life and living annuities. Indeed, these products are often confusing and difficult to navigate for the lay person.

Below is a Q&A that seeks to simplify these products and promote a better understanding of their benefits and potential drawbacks…