National Budget 2018/2019 – How Does It Affect You?

Finance Minister Malusi Gigaba delivered in his words “a tough but hopeful budget” after which the Rand firmed by almost 1%

Maximum marginal rate for natural persons remains at 45%. It is reached when taxable income exceeds R1 500 000.

WHAT ELSE REMAINS THE SAME?

- Minimum rate of tax remains at 18% on taxable income not exceeding R195 850.

- Tax free portion of interest income remains at R23 800 for taxpayers under 65 years and R34 500 for those aged 65 years and older.

- Tax-free saving dispensation for other investments remains at R33 000 per tax year.

- Local dividend tax remains at a flat 20% rate. Foreign dividends also remain at a flat rate of 20%.

Capital Gains:

- The annual capital gain exclusion for individuals remains at R40 000.

- The primary residence exclusion from capital gains tax remains at R2 million.

- Capital gain exclusion at death remains at R300 000.

Retirement funds: The tables remain the same. To view the tables click here.

The offshore investment allowance remains at R10 million per adult person per calendar year. In addition the R1 million individual single discretionary allowance remains.

Companies and Close Corporations: the rate of normal tax remains at 28%.

WHAT CHANGES?

Individual Tax Thresholds:

- Under 65 years: R78 150 (previously R75 750)

- 65 -74 years: R121 000 (previously R117 300)

- 75 years and older: R135 300 (previously R131 150)

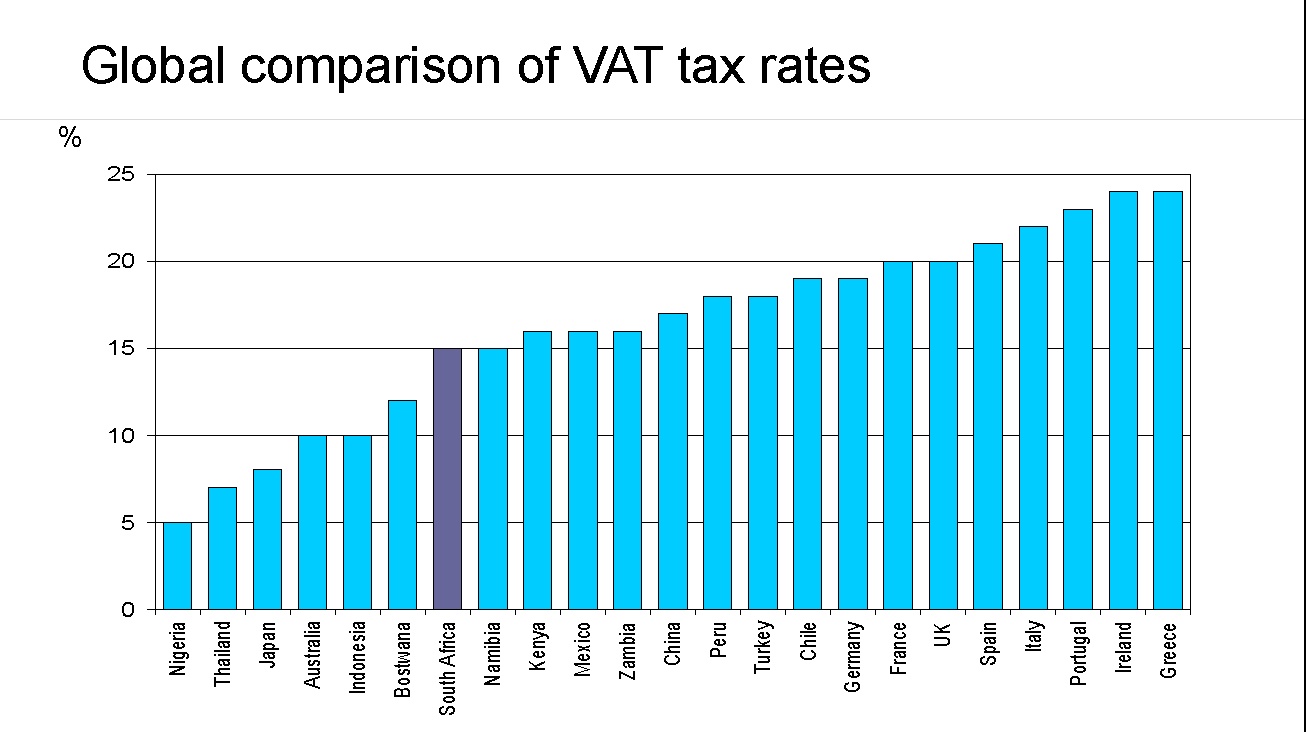

VAT: The rate increases to 15% from 14% effective 1 April, 2018. (click on the graph to enlarge)

Fuel Levy increased by 52c a litre.

Estate Duty raised to 25% for estates of greater than R30 million.

Excise Duty on luxury goods raised from 7% to 9%.

Finally ……………

“Fortunately, the latest set of budget parameters, together with recent political developments, greatly reduces the chances of further credit downgrades in the short-term” Kevin Lings, Chief Economist, Stanlib.

Source: National Budget, Anchor Capital, Stanlib