Rand Blowout ‘unlikely’

The rand fell to levels last seen in 2001 in recent weeks as the slowdown in China and a stronger dollar wreaked havoc among emerging market currencies. This fueled fears that the local currency could plummet to R20 to the greenback. But such a blowout is unlikely, reports Ingé Lamprecht for Moneyweb. Click to read the article “Rand blowout ‘unlikely’ “

A Quick Glance Back at the Second Quarter…

The end of the second quarter (June) proved rather eventful for investors eyeing global markets: heated political arguments around debt repayments in Greece; the U.S. Federal Reserve’s ‘almost confirmation’ of a 2015 interest rate hike and uncertainty over China’s economic outlook dominated the news headlines and fuelled a bearish sentiment.

Economic Wrap from Stanlib’s Kevin Lings (June 2015)

These economic updates from Kevin Lings, the Chief Economist at Stanlib, on the South African and global economies are insightful. This video covers the South African economy (June 2015).

Source: STANLIB.

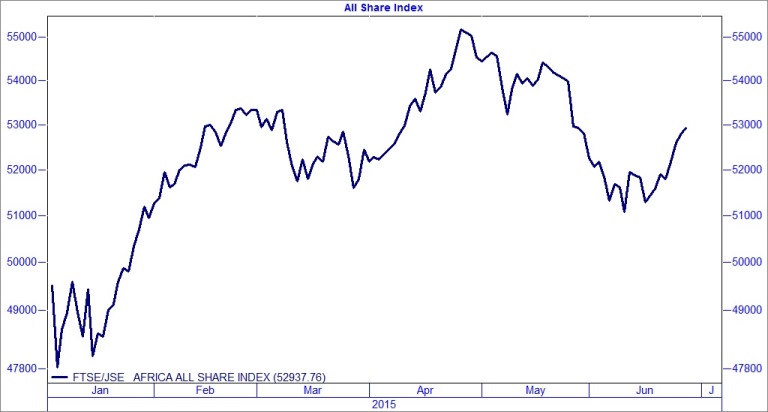

Rollercoaster Ride on the JSE

It has been another roller-coaster ride on the JSE, as the graph below shows. The sometimes steep ups and downs of the exchange illustrate why long-term investors should not be alarmed by short-term market movements. From a drop at the beginning of the year, the All Share Index went up steeply, albeit not in a straight line, until mid-March, when it took a breather, before soaring to a record high at the end of April. But May and June saw it drop – external influences such as fears of a Greek default, or worries about when US rates would be hiked – have been cited as amongst the factors influencing that drop. But come June the index went jogging upwards again. So it has been said before but it is worth repeating here – investors should not lose sleep over short-term volatility.

Game over for Tax Dodgers?

Is it game over for tax dodgers? As Ingé Lamprecht reports for Moneyweb, there is virtually no place to hide as countries adopt a system of the automatic exchange of information. Click to read the article “Game over for Tax Dodgers?”

How to Keep ‘matters of the Heart’ from Derailing Your Finances…

As anyone involved in financial planning and wealth management could undoubtedly testify, emotions are usually public enemy number one when it comes to sticking to financial plans. While frightening news or industry generated information can influence people’s decisions, it is more often the major life events – and the resulting emotional upheavals – that lead to financial plans going awry.

In the first of these articles, we will address two ‘matters of the heart’ that greatly influence our financial decisions: marriage and divorce.

The Issue with Impulse Investing

In these days of instant news via digital channels people can be bombarded by masses of financial information. But Ingé Lamprecht warns investors to think carefully before waging their long-term goals on short-term investment news stories. Click here to read the article.