How to Keep ‘matters of the Heart’ from Derailing Your Finances…

As anyone involved in financial planning and wealth management could undoubtedly testify, emotions are usually public enemy number one when it comes to sticking to financial plans. While frightening news or industry generated information can influence people’s decisions, it is more often the major life events – and the resulting emotional upheavals – that lead to financial plans going awry.

In the first of these articles, we will address two ‘matters of the heart’ that greatly influence our financial decisions: marriage and divorce.

The Issue with Impulse Investing

In these days of instant news via digital channels people can be bombarded by masses of financial information. But Ingé Lamprecht warns investors to think carefully before waging their long-term goals on short-term investment news stories. Click here to read the article.

You Need a Ten-year Horizon to Be in Equities

Patrick Cairns, in an insightful Moneyweb article, writes that you need a ten-year horizon to be in equities. And if you can’t sit it out, then you should be in cash. Click here to read the article.

Should You Care about Global Crises?

What is the individual investor to do when global events threaten to bring turmoil to the markets? Should one ignore the supposed horses of the apocalypse or take your investments and run for safer havens? One of our contributors, Jessica Hubbard, canvasses the opinions of some experts.

Are You Truly Wealthy or a Debt-ridden Wannabe?

Being a high-earner does not automatically make you a wealthy person. In fact, as Jessica Hubbard, one of our contributors reports, a depressingly small percentage of those who earn big salaries manager to transfer that into being high net-worth individuals and families. So how can you avoid the debt trap awaiting the big-bucks earners? Click to read the article: “Are you truly wealthy or a debt-ridden wannabe?”

Fear and Loathing: Are Woman Not Fully Financially Empowered yet?

The issue of woman’s relationship to finance and money is interesting. One of our contributors, Jessica Hubbard, wrote an article for Finweek in which I participated. Click to read the article: “Fear and Loathing: Are woman not fully financially empowered yet?”

The Accidental Investor: Bad Timing

The first in our series of light hearted columns entitled ‘The Accidental Investor’ by one of our contributors, Nick Warren. This one is called ‘Bad Timing’. Enjoy…

…I’ve made some mistakes in my time, and quite often those mistakes have been about timing. There are many categories of mistake of course, from the most meaningless and mundane to the most devastating and divine, but almost all of them come down to timing. “If I’d had more time to think it through I might have made a different decision, if I’d had less time to think about it I would have gone with my instinct!”

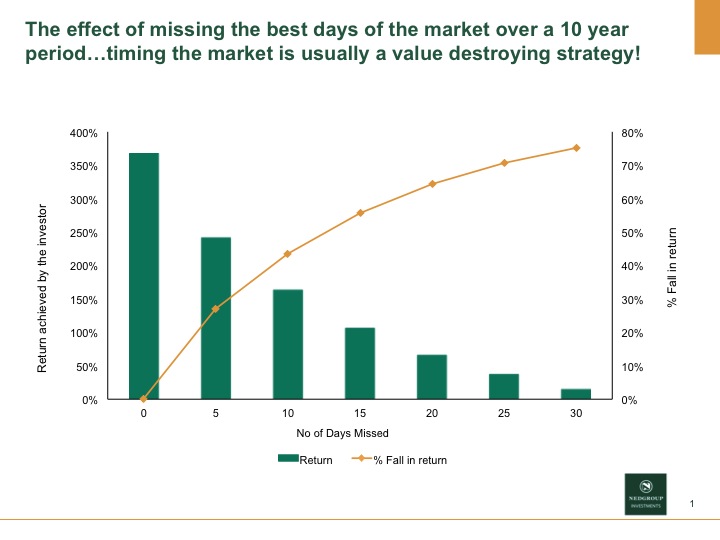

Timing the Market

“Timing the market is usually a value destroying strategy!” Have a look at Nedgroup Investments’ graph which shows the effect of missing the best days of the market over a 10 year period. Read more about investor mistakes in our “8 Curiously Common Mistakes That Investors Make” article.

Are We Born to Spend?

Behavioural Economics has become firmly established as both a tool through which to assist people with their finances, as well as a lens through which to assess and analyse the way we handle money.

While it is still a relatively new concept in South Africa, perhaps we can draw on the discipline to tackle our dismal savings rate and poor financial habits?

In this brief excerpt from a Finweek magazine cover story by one of our contributors, Jessica Hubbard, she asks the question…

Are We Born to Spend?

Looking Ahead at Markets and Inflation

Following on from the “8 Curiously Common Mistakes That Investors Make” article and how it is often human nature to expect investment returns to only go up after a period of good returns, it is worth noting that a generally held view amongst asset managers is that we are going into a lower-return, higher inflation world. The point is it would be prudent to lower our expectations going forward.