Weekend Reads: Trump and Technology

Two interesting reads for the long weekend. I hope you find them as insightful as I did:

Trump’s trade war: even worse than you think, by Professor Barry Eichengreen

Why Technology Favors Tyranny (An article adapted from Yuval Noah Harari’s book, 21 Lessons for the 21st Century) – The Atlantic

Quarterly Economic Review: Us/China Trade Dispute Weighs Heavily on Outlook

The broader, global view…

- The ongoing and often vicious trade dispute between the US and China has led to a material slowdown in global trade during the first half of 2019;

- Major Central banks, in particular the US Federal Reserve (FED) and the European Central Bank (ECB) have indicated that they will probably provide additional stimulus during the second half of the year to help offset some of the weaknesses caused by the slowdown in global trade;

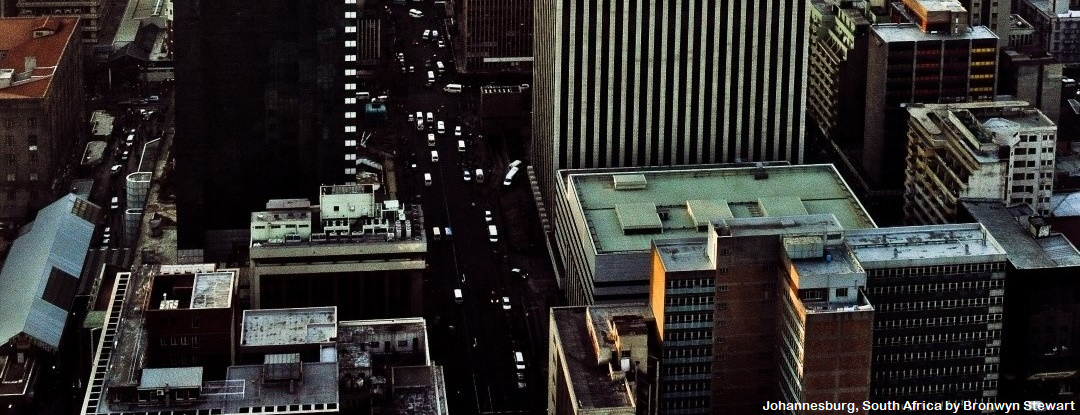

- South Africa has not been immune to the negative effects of the trade disputes and export performance in 2019 has been adversely affected by the slowdown

Interview with David Gillson: Trip to Iceland

I have always loved travel, and so I am thrilled to be adding some more travel articles to my blog. I think you will find this series of travel Q&A enjoyable, but also interesting, as we delve a little into how much things cost and how the economies in various countries are developing… or not.

This first Q&A is on Iceland… and how expensive a glass of wine is!

Weekend Read: Intriguing TV

An entertaining read to enjoy this weekend, from one of my favourite online resources. Enjoy!

Big Little Lies – Why Meryl Streep’s Sly Matriarch Works So Well – The Atlantic

Returning to the Basics of Savvy Investing

With so much negativity in the news of late, coupled with an election year, investors have understandably been jittery. A cautious investment environment – with many unsure of the best strategy to pursue, has reflected this sentiment. With this in mind, now is a good time to revisit the basics of smart, long term investing.

Silver Lining for Distressed Investors: ‘sow the Seeds’ Now for Future Returns

In a socio economic environment characterised by volatility and deep-seated uncertainty, local investors are understandably spooked. Coupled with three years of poor returns from shares and listed property, many investors are (naturally) questioning why they should not cut their losses and switch to cash. This anxiety was exacerbated following the worst December for US equities since the Great Depression. Yet for savvy investors, there is always a silver lining to market dips.

Let’s take a closer look at the trends…

Looking Back: What Did the 4th Quarter of 2018 Hold for Investors?

For local investors, December capped an incredibly challenging year. It was the first time in many years that all major global asset classes produced a negative real return. Notably, emerging markets seemed to bear the brunt of the risk-off environment throughout the year – which meant that it was another very disappointing year for investors on the JSE. Tellingly, the FTSE JSE All Share Index closed 2018 with a negative total return of -9.08%.