Taking a Look Back at the Third Quarter, 2018

In South Africa, low returns continue to be off-putting for investors, but the case for staying the course remains strong. On a macro level:

- The SARB left the repo rate unchanged at 6.5% at both the July and September meetings. Many analysts believe that the MPC will keep the rates on hold in Q4 2018, in the face of relatively benign inflation pressure and weak growth.

- The Rand, caught in the Emerging Market currency turmoil, had a volatile Q3-18. The USD/ZAR traded in a range from USD/ZAR 13.90 in July to a peak of R15.4 in September. The Rand then pulled back to R14.14 at the end of the quarter.

- Inflation accelerated modestly in Q3-18 compared to Q2-18, averaging 5% from 4.5% the previous quarter.

Why Time in the Market Is More Important than Trying to Time the Market

With the JSE All Share reaching 60 127 this morning (29/08/2018), it is valuable to revisit some basic principles that make for successful long-term investment strategies.

Indeed, it is easy to forget that in April this year the JSE All Share dropped to 54 602 (4/4/2018). This fact highlights the inherent futility of trying to time the market.

I have mentioned this in previous articles “Staying Invested Vs Timing Markets”. In short, it is always better to stick to well thought out investment strategies and to avoid emotional reactions to negative market movements.

The graph below is a powerful illustration of why time in the market is more important than trying to time the market! (click on the graph to enlarge)

A Brief Look Back at the 2nd Quarter, 2018

Halfway through a rather turbulent political year, domestic asset classes are starting to reveal that the Ramaphosa-led government is facing significant headwinds. Although a tough budget stance managed to stave off a credit rating downgrade, there is still a long way for the local economy to go before investors can rest easy…

Why Local Investors Need to Stay the Course, Despite Low Returns

Stagnant market calls for a cool head…

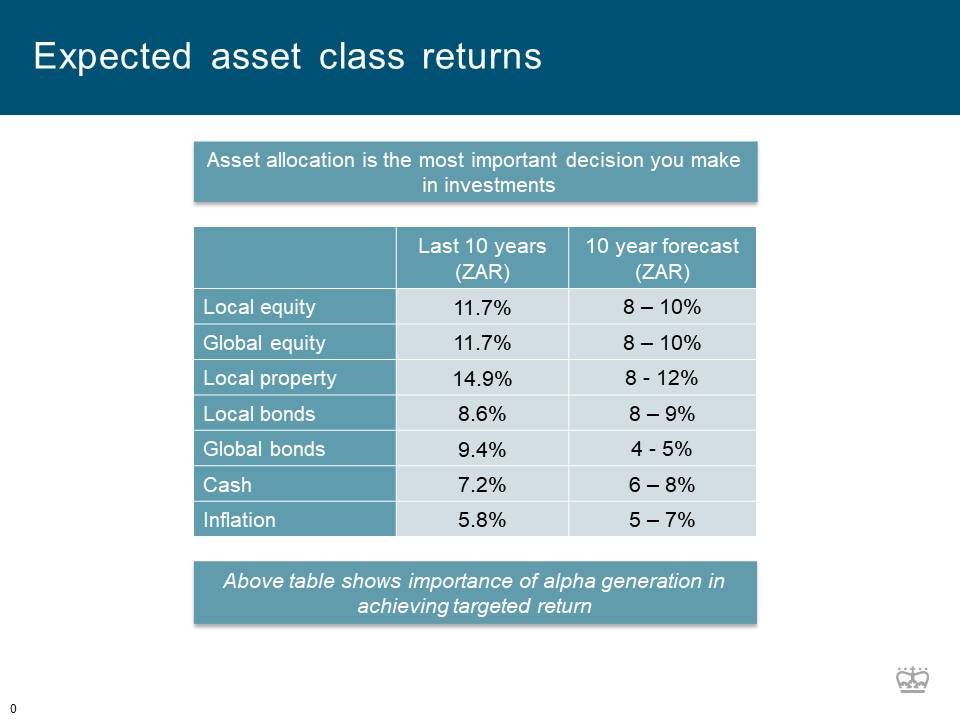

Over the past three years, most SA investors have been disappointed with their returns. This is unsurprising, given the figures. For example, the average SA Multi-Asset High Equity unit trust did 3.4% per annum over the three years ended March 2018. Overall, the available asset classes have delivered poor returns, as can be seen in the table below.

Expected Asset Class Returns

Below find a graph prepared by Coronation Fund Managers on expected asset class returns and inflation for the next 10 years. This is an updated graph on two previous articles “Looking ahead at Markets and Inflation” / “Expected Asset Class Returns over the next 10 Years”