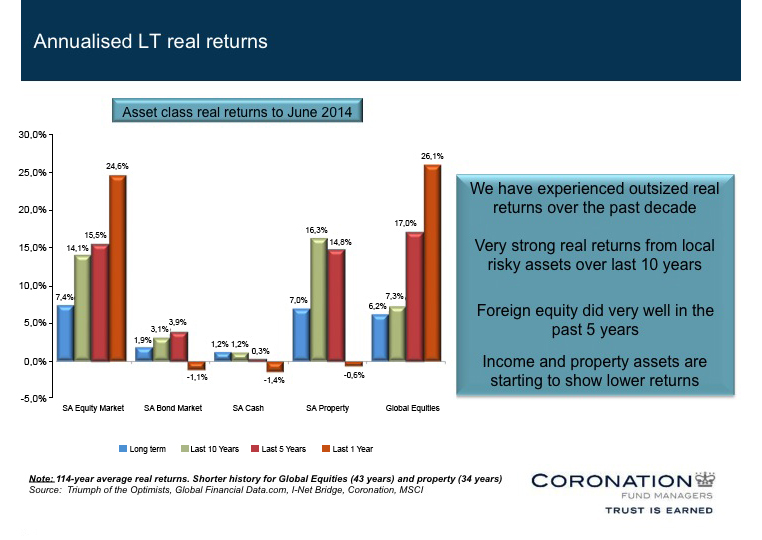

Annualised Long Term Real Returns

I refer to a previous post on the blog “Looking Ahead at Markets and Inflation“ which gives Coronation Asset Managers’ perspective on the returns of financial markets going forward. This is another interesting graph which gives the long term averages. You will see that these are lower than the returns for the various asset classes over the past 10 years, 5 years and 1 year. Markets tend to revert to their long term averages. This graph therefore supports their view that going forward, returns will be more muted.

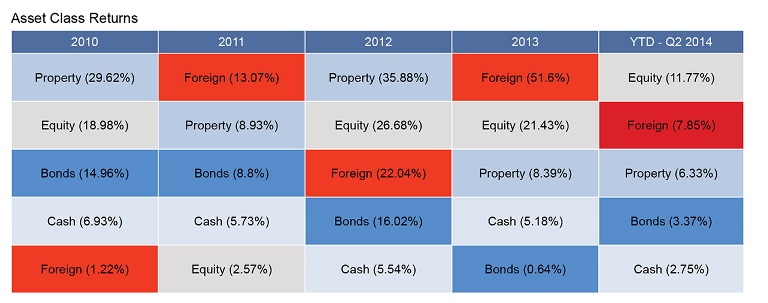

Why Balanced Funds Are Holding More Cash

With the JSE’s All Share Index at new highs (closed on the 24th of June at 50 890) it is interesting to note that a number of balanced fund managers are holding a larger percentage of cash in their funds. Coronation, Allan Gray and PSG Fund Managers explain their rationale for this in a Moneyweb article. Click to read the article: “Why balanced funds are holding more cash”

IN THE NEWS: Foreign Capital Flows Back into SA

The rand has been on a roller-coaster ride, as has sentiment towards the JSE and other emerging-market stock exchanges. What is behind the volatility and what is the outlook? Moneyweb investigates. Click here to read the article.

A Brief Review of the First Quarter of 2014 and Events That Moved the South African Market

While we are constantly bombarded with news of crises in every corner of the world – from tensions in the Ukraine to missing planes – it is hard to keep track of which events are affecting us right down to the so-called bottom dollar.

To simplify matters, here is a brief look at some of the occurrences and currency shifts that have shaped the markets in a rather eventful (and as always, unpredictable) way in the first quarter of 2014:

Looking Ahead at Markets and Inflation

Following on from the “8 Curiously Common Mistakes That Investors Make” article and how it is often human nature to expect investment returns to only go up after a period of good returns, it is worth noting that a generally held view amongst asset managers is that we are going into a lower-return, higher inflation world. The point is it would be prudent to lower our expectations going forward.

Welcome to Our Blog

Dear Client,

Over the years I have found that there is a large psychological/ behavioural aspect to investing and the Blog will focus on this. However, this will not be to the exclusion of other relevant information and financial planning issues. And so that we do not get too serious, there will also be regular postings by a columnist and cartoonist to provide some financial (and non-financial) humour. We will focus on a certain topic every month, but will also comment on any current and relevant “in the news” stories as they happen – in South Africa as well as around the world.

We are all bombarded with information, a lot of it unwanted, on a daily basis so access to the Blog will be driven by you.

If you would like to receive email notifications when a new article is loaded onto the Blog, please use the subscription function on the right hand side of this blog page. The subscription function is spam protected.

I hope you enjoy and get value out of the Blog.

Joy Immelman