Silver Lining for Distressed Investors: ‘sow the Seeds’ Now for Future Returns

In a socio economic environment characterised by volatility and deep-seated uncertainty, local investors are understandably spooked. Coupled with three years of poor returns from shares and listed property, many investors are (naturally) questioning why they should not cut their losses and switch to cash. This anxiety was exacerbated following the worst December for US equities since the Great Depression. Yet for savvy investors, there is always a silver lining to market dips.

Let’s take a closer look at the trends…

Looking Back: What Did the 4th Quarter of 2018 Hold for Investors?

For local investors, December capped an incredibly challenging year. It was the first time in many years that all major global asset classes produced a negative real return. Notably, emerging markets seemed to bear the brunt of the risk-off environment throughout the year – which meant that it was another very disappointing year for investors on the JSE. Tellingly, the FTSE JSE All Share Index closed 2018 with a negative total return of -9.08%.

Taking a Look Back at the Third Quarter, 2018

In South Africa, low returns continue to be off-putting for investors, but the case for staying the course remains strong. On a macro level:

- The SARB left the repo rate unchanged at 6.5% at both the July and September meetings. Many analysts believe that the MPC will keep the rates on hold in Q4 2018, in the face of relatively benign inflation pressure and weak growth.

- The Rand, caught in the Emerging Market currency turmoil, had a volatile Q3-18. The USD/ZAR traded in a range from USD/ZAR 13.90 in July to a peak of R15.4 in September. The Rand then pulled back to R14.14 at the end of the quarter.

- Inflation accelerated modestly in Q3-18 compared to Q2-18, averaging 5% from 4.5% the previous quarter.

A Brief Look Back at the 2nd Quarter, 2018

Halfway through a rather turbulent political year, domestic asset classes are starting to reveal that the Ramaphosa-led government is facing significant headwinds. Although a tough budget stance managed to stave off a credit rating downgrade, there is still a long way for the local economy to go before investors can rest easy…

Why Local Investors Need to Stay the Course, Despite Low Returns

Stagnant market calls for a cool head…

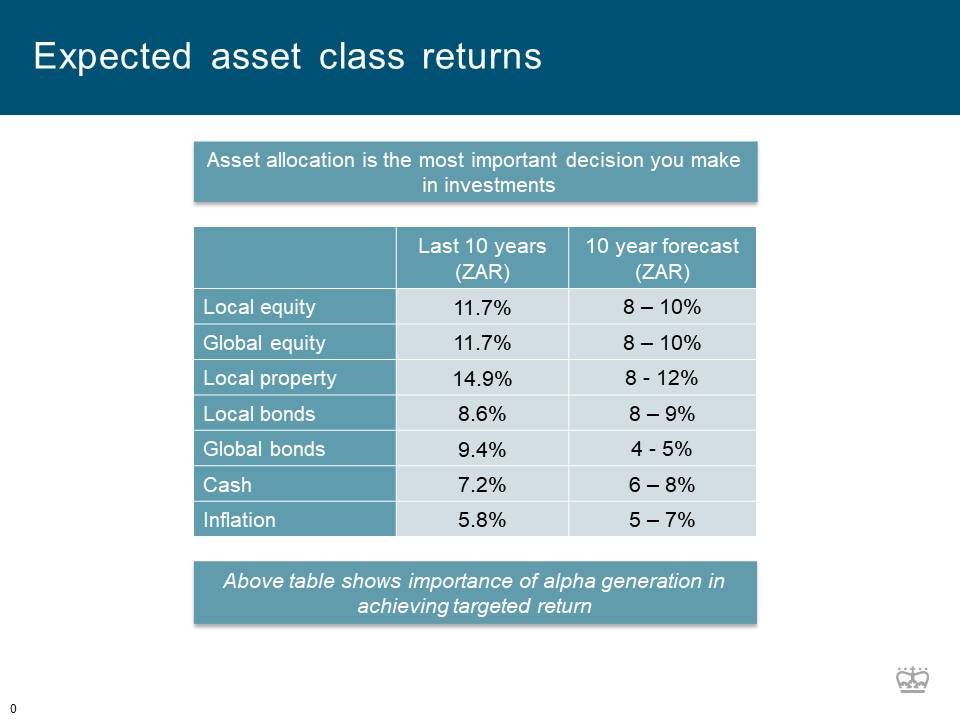

Over the past three years, most SA investors have been disappointed with their returns. This is unsurprising, given the figures. For example, the average SA Multi-Asset High Equity unit trust did 3.4% per annum over the three years ended March 2018. Overall, the available asset classes have delivered poor returns, as can be seen in the table below.

Expected Asset Class Returns

Below find a graph prepared by Coronation Fund Managers on expected asset class returns and inflation for the next 10 years. This is an updated graph on two previous articles “Looking ahead at Markets and Inflation” / “Expected Asset Class Returns over the next 10 Years”